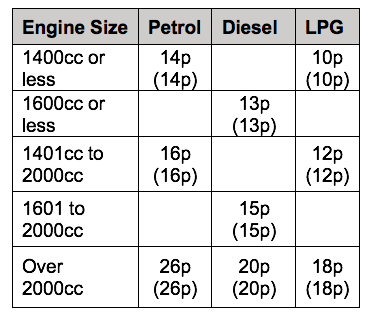

Advisory Fuel Rate for Company Cars

The table below sets out the HMRC advisory fuel rates from 1 March 2024. These are the suggested reimbursement rates for employees' private mileage using their company car.

Where the employer does not pay for any fuel for the company car, these are the amounts that can be reimbursed in respect of business journeys without the amount being taxable on the employee.

Where there has been a change the previous rate is shown in brackets.

You can also continue to use the previous rates for up to 1 month from the date the new rates apply.

Note that for hybrid cars you must use the petrol or diesel rate.

For fully electric vehicles the rate is 9p per mile.